Supreme What Does Non Standard Auto Insurance Mean

What does a non-standard auto insurance policy actually mean.

What does non standard auto insurance mean. Drivers are usually grouped into one of three categories when it comes to auto insurance. Should I Get Non-Standard Auto Insurance. Non-standard auto insurance companies also often write policies for drivers who are older than 70 or younger than 20.

Non-standard policies may lack coverage compared to standard policies in some areas. A nonstandard or high-risk auto insurance policy isnt a specific type of car insurance policy. Non-standard auto insurance.

This coverage typically pays the difference between the amount recovered from the other driver and the amount of the damages up to the limit of the policy. Sometimes these drivers have difficulty obtaining insurance at all. It just means youre getting auto-insurance meant for high-risk drivers.

A person may become ineligible for a traditional car insurance policy because of a number. If youre ever denied insurance coverage from an insurance company or issued a non-renewal theres a possibility youll need to seek a non-standard. It may not extend to rental cars either.

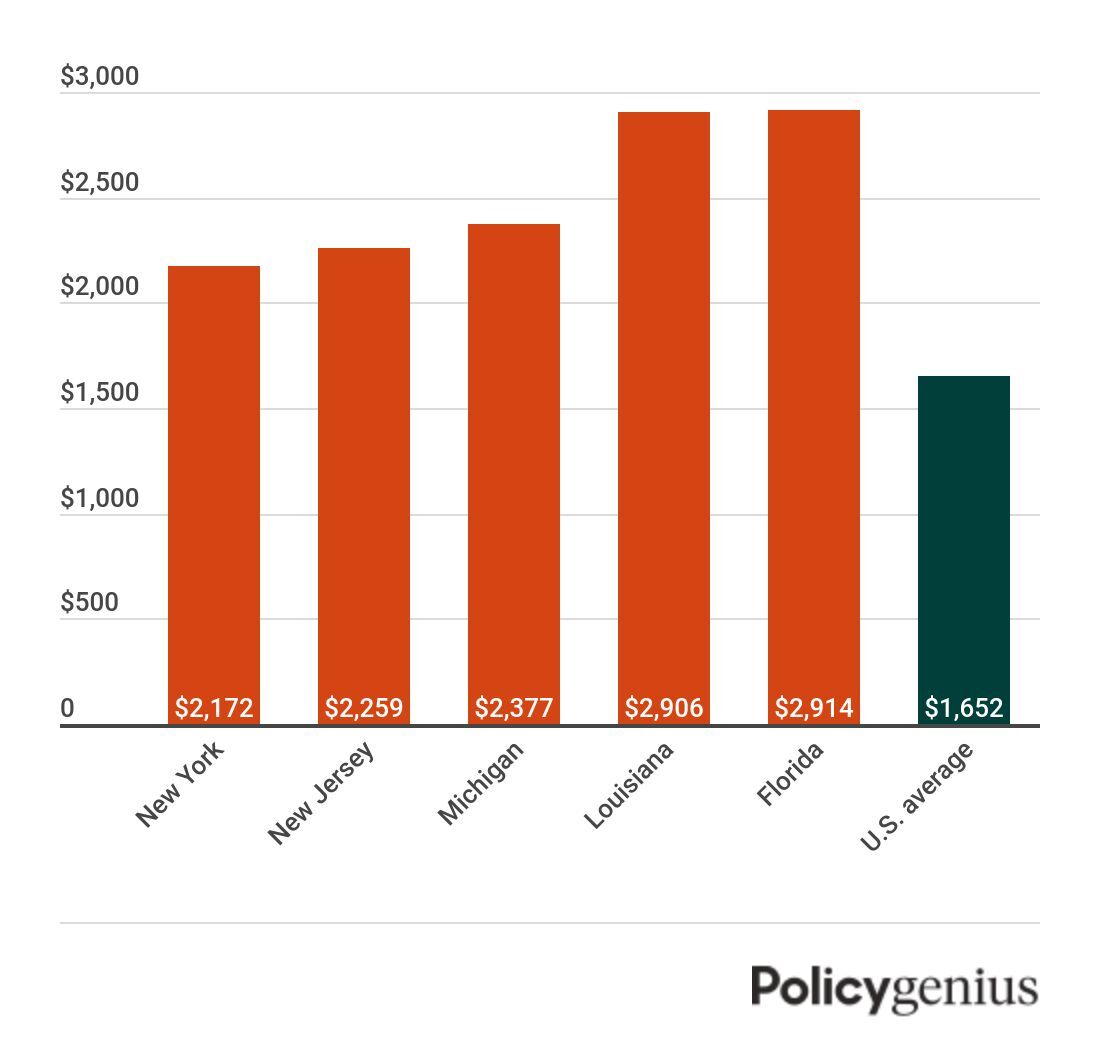

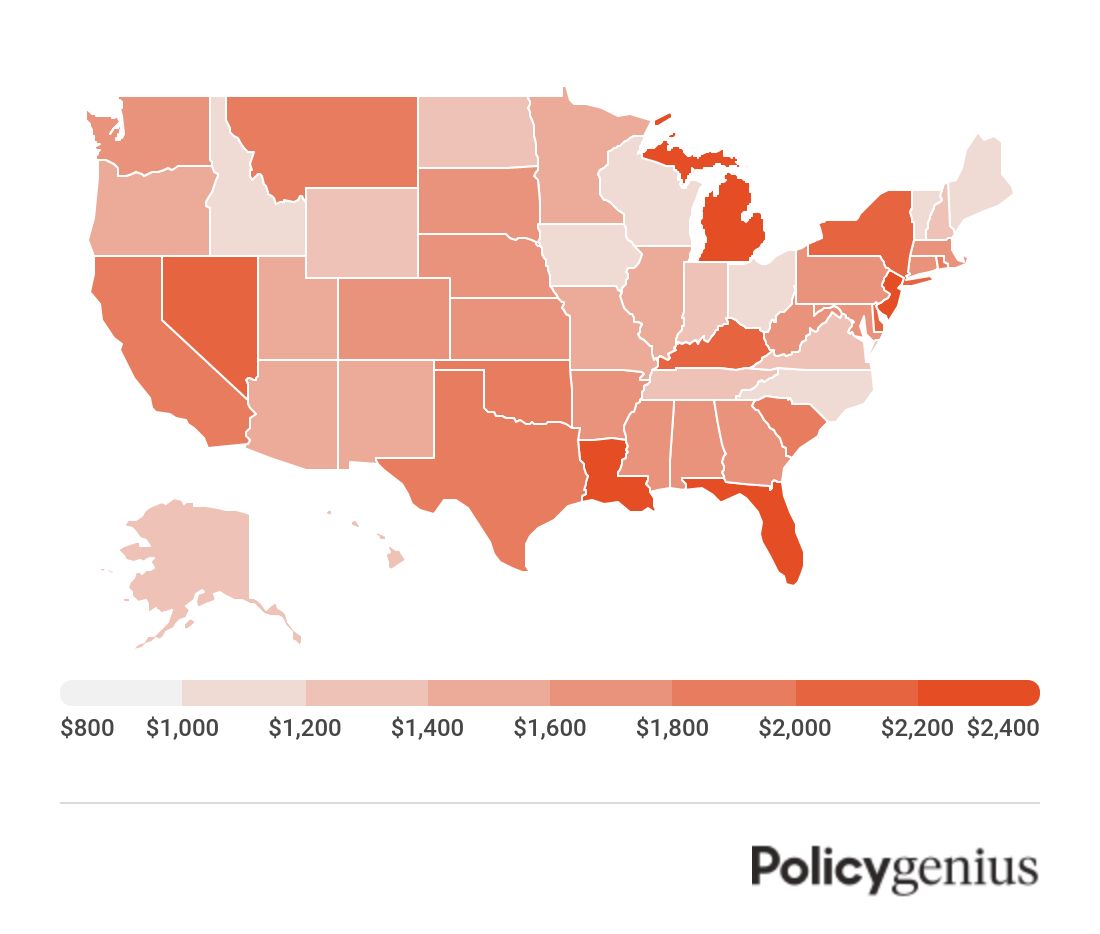

Non-standard auto insurance is a term to classify insurance sold to drivers whose risk factors make it difficult or impossible to obtain insurance at standard or preferred rates. Non-standard auto insurance is an auto insurance option for high-risk or non-low-risk drivers. Non-standard car insurance is a blanket term that is used to describe an auto insurance policy written for an individual who is considered difficult to insure.

Typically this means higher rates. Non-standard auto insurance is any type of auto insurance sold to people who would typically be unable to get it. Nonstandard auto insurance has been traditionally defined as a market for drivers who have certain risk factors that make it.

/national-general_inv-8f528b3781bf406e8035744dbcaf9073.png)